|

| Obama and Biden rejoice over their "excellent" strategy |

Former Treasury Department big, Emil Henry, has a concise piece in the WaStreJo this AM (my attempt at text/Twitter shortening of the Wall Street Journal) titled "America's Debt Ceiling Opportunity," He cites the report "USA, Inc." - a report we have discussed in these pages before - that is a bi-partisan effort to look at the Federal Government's finances as a business would. You wouldn't buy shares in this firm - here's their 2010 summary:

For example, if Congress had submitted fiscal year 2010 financial reports of our country in a fashion similar to a corporation, the U.S. would show a negative net worth of $44 trillion, an operating loss of $817 billion, and $1.3 trillion of negative cash flow.

Reminds me of the scene in the movie "Dave:"

The way out of this morass is growth. As Henry points out in his article - 5% growth and we are home-free. We've been averaging just north of 2.5% for the last 20 years, so we've got some room to give. But when you consider the other places growth could occur, a stable and prosperous United States is not that bad. As we've discussed here before, we don't believe in the Chinese miracle over the long haul. Europe? Done. Africa? Good luck. Japan? Done. Some good prospects in the Asian/South Pacific markets, but security is a big concern. So, the point is, the US of A is not a bad place to invest money. IF you would get the Washington bureaucrats out of the picture. OR, we could settle for some more of that good old malaise. That's what Michael Spence, over at the Economist fears is in the mix: "America the Sclerotic." OK, Michael, we're a

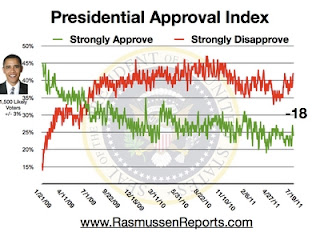

Cut, Cap and Balance is headed for a vote today. The adults in Washington continue to try to lead - sadly, the petulant Obama will probably veto it, so it is only symbolic. But hey - he continues to be popular:

If you turn the graph upside down.

Hot day ahead!

Rumble on!

No comments:

Post a Comment